Best Tips About What Is The Smooth Line In Moving Average How To Add A Chart Excel

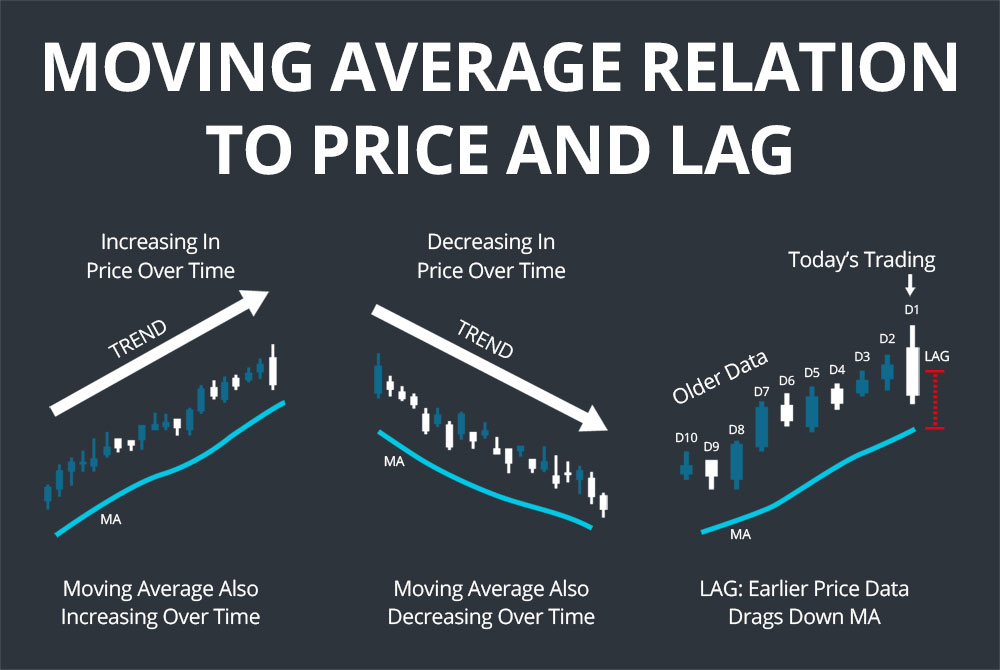

Smoothing is the process of removing random variations that appear as coarseness in a plot of raw time series data.

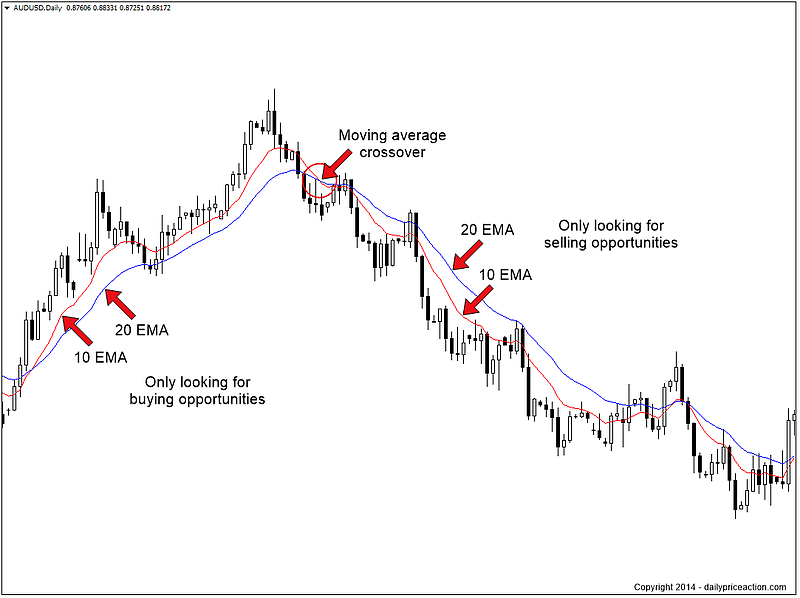

What is the smooth line in moving average. Moving average smoothing is a naive and effective technique in time series forecasting. We will cover everything you need to know to understand and trade moving averages. An upper band, a lower band, and a moving average line.

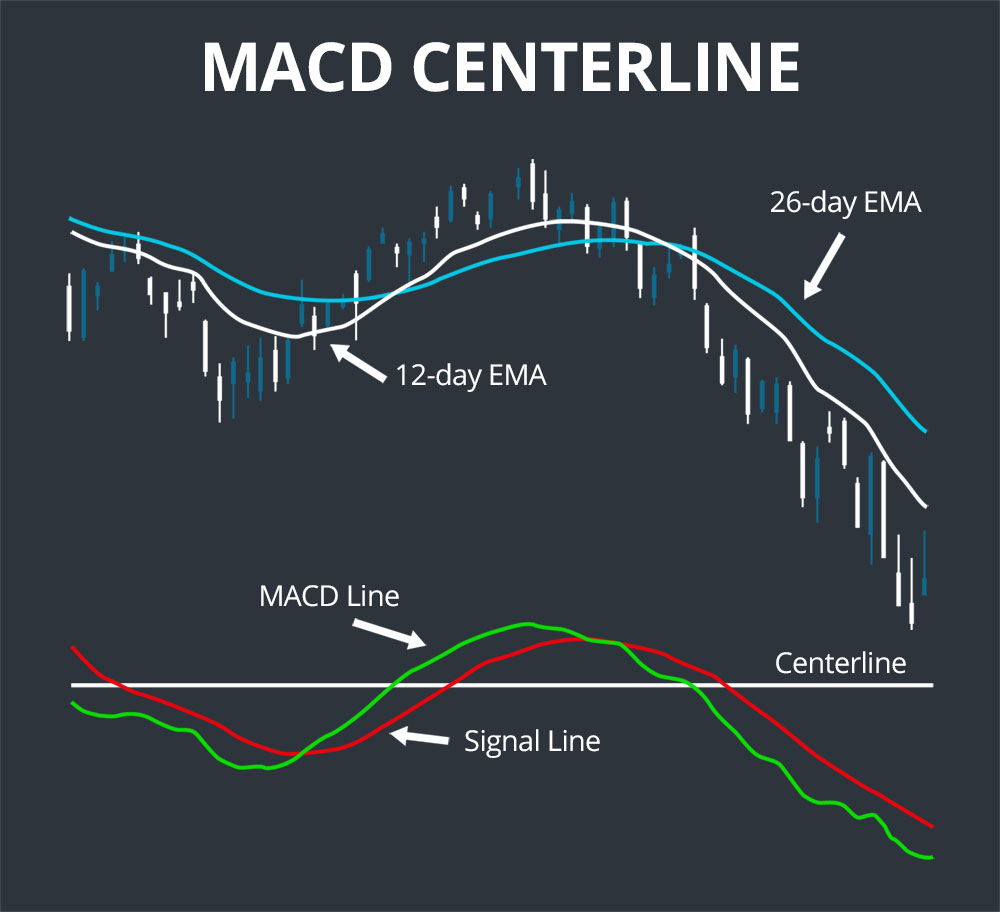

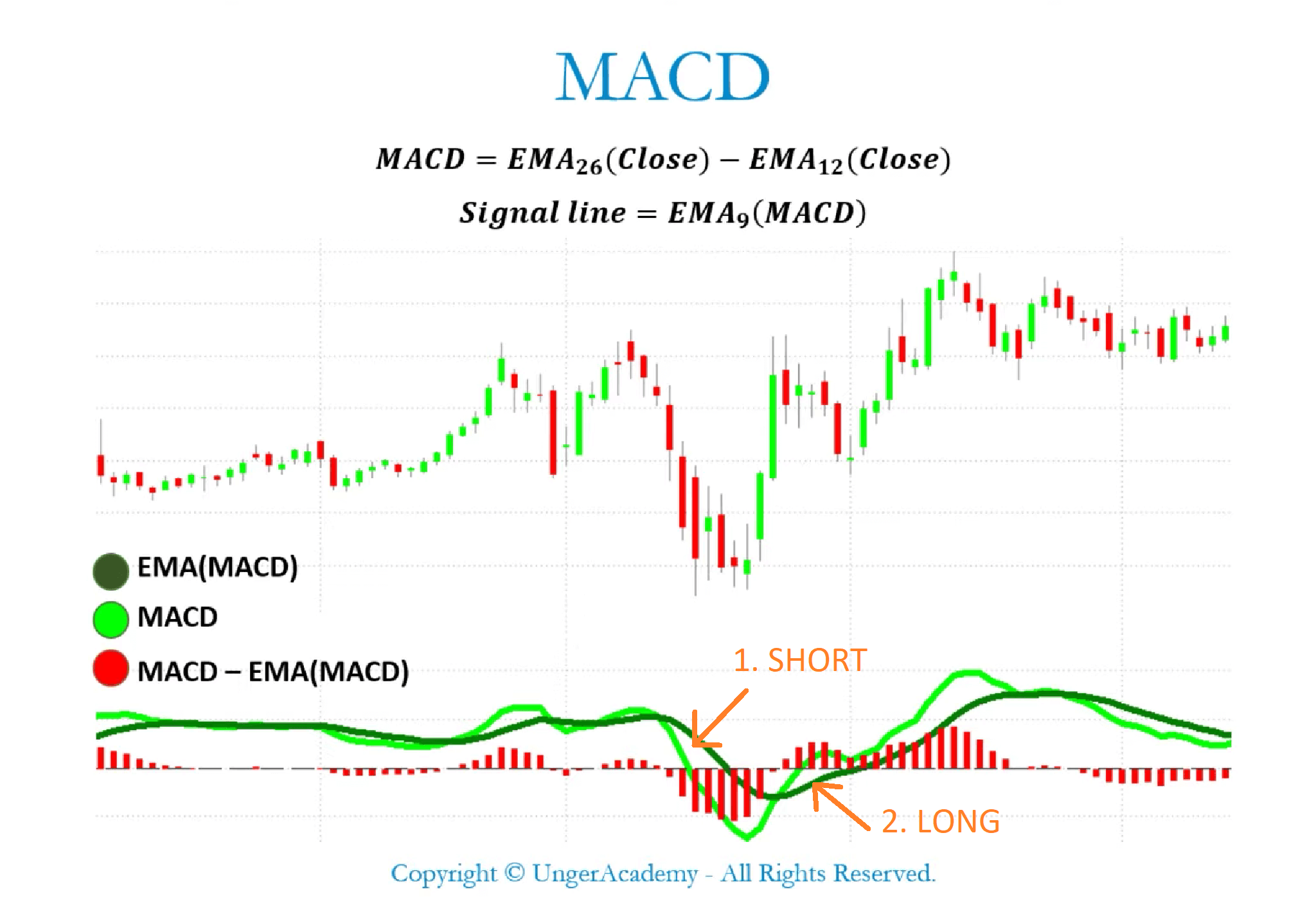

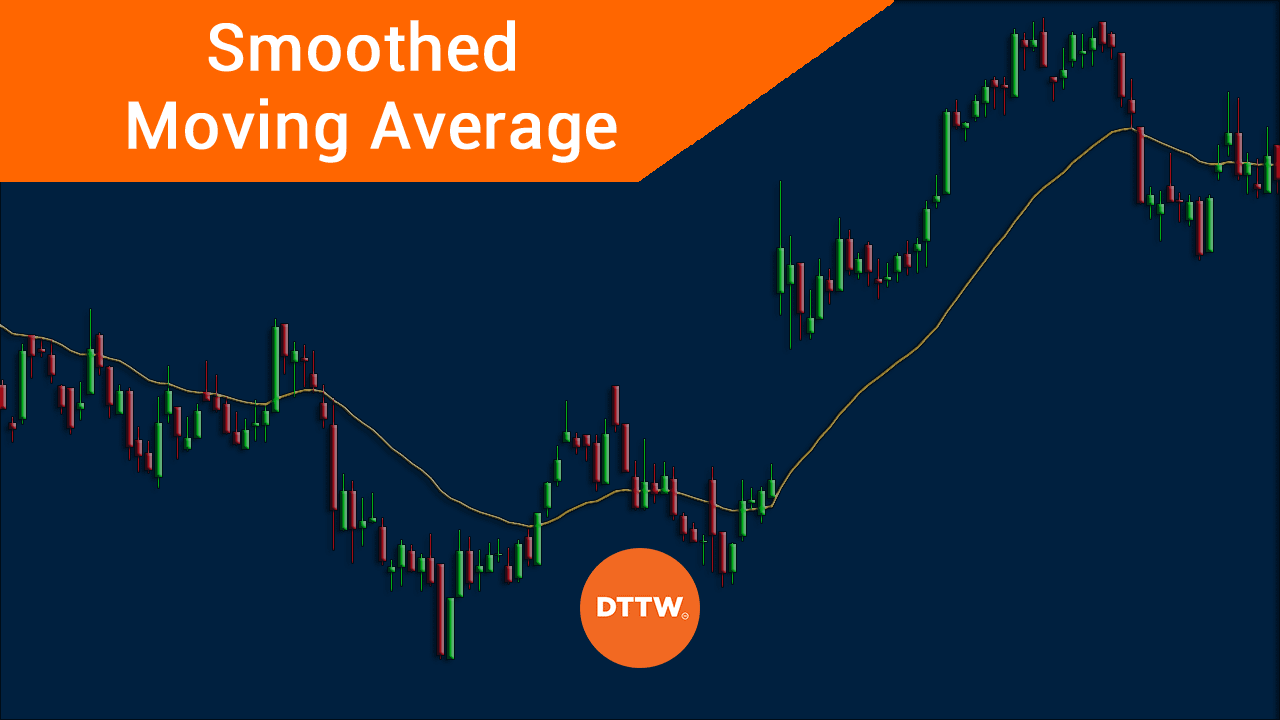

What is the smoothed moving average? The smoothed moving average (smma) is a technical indicator used by traders to gauge price momentum and trends in a given asset. Traders use it to gauge market trends according to.

After completing this tutorial, you will know: Why is it called “moving”? No future data is used.

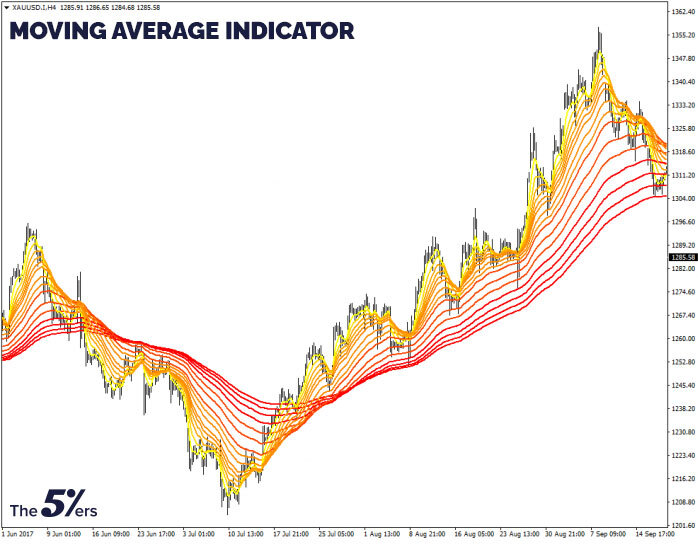

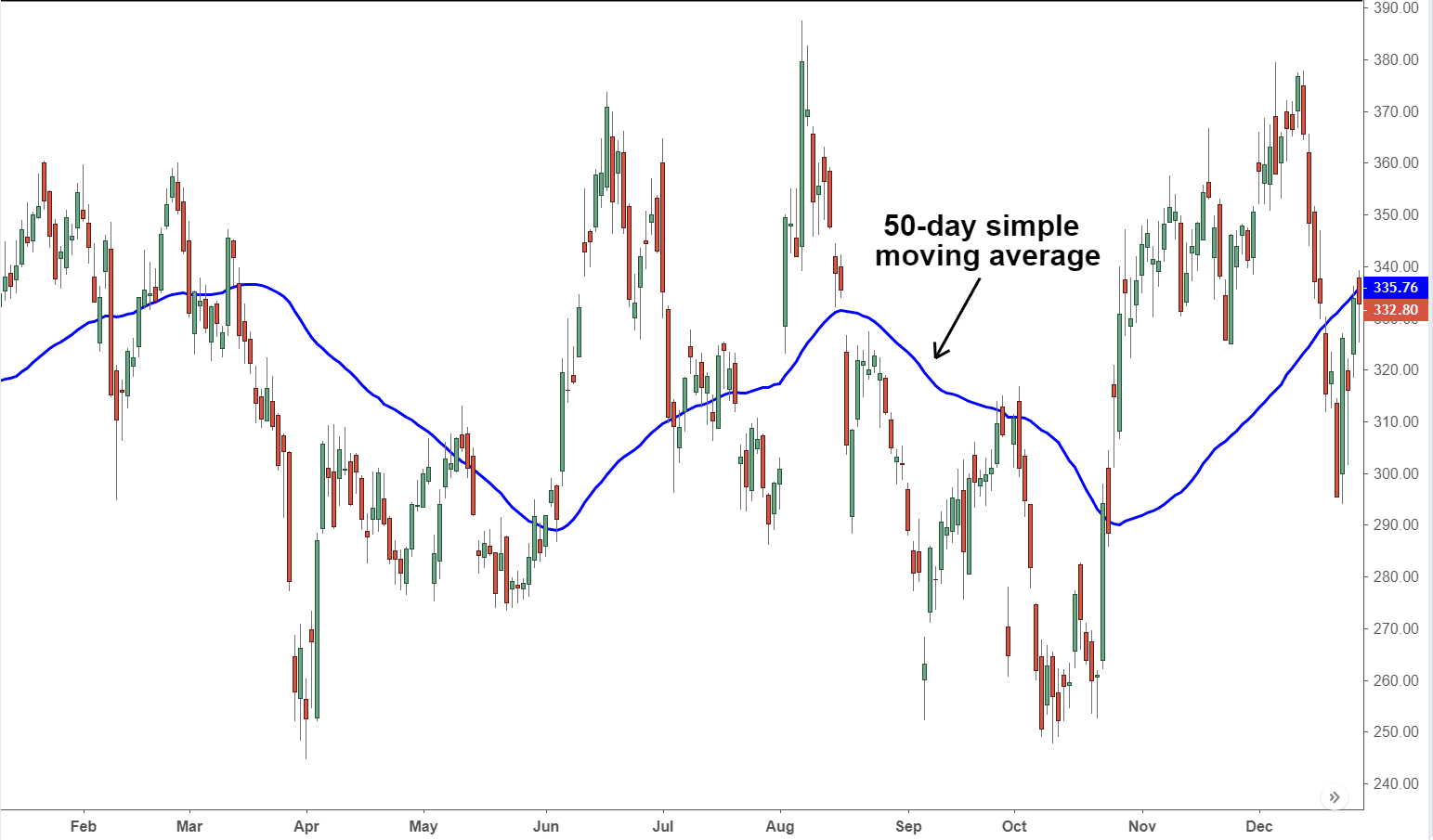

Bollinger bands consist of three lines: Moving averages are trend indicators and are frequently used due to their simplicity and effectiveness. In this tutorial, you will discover how to use moving average smoothing for time series forecasting with python.

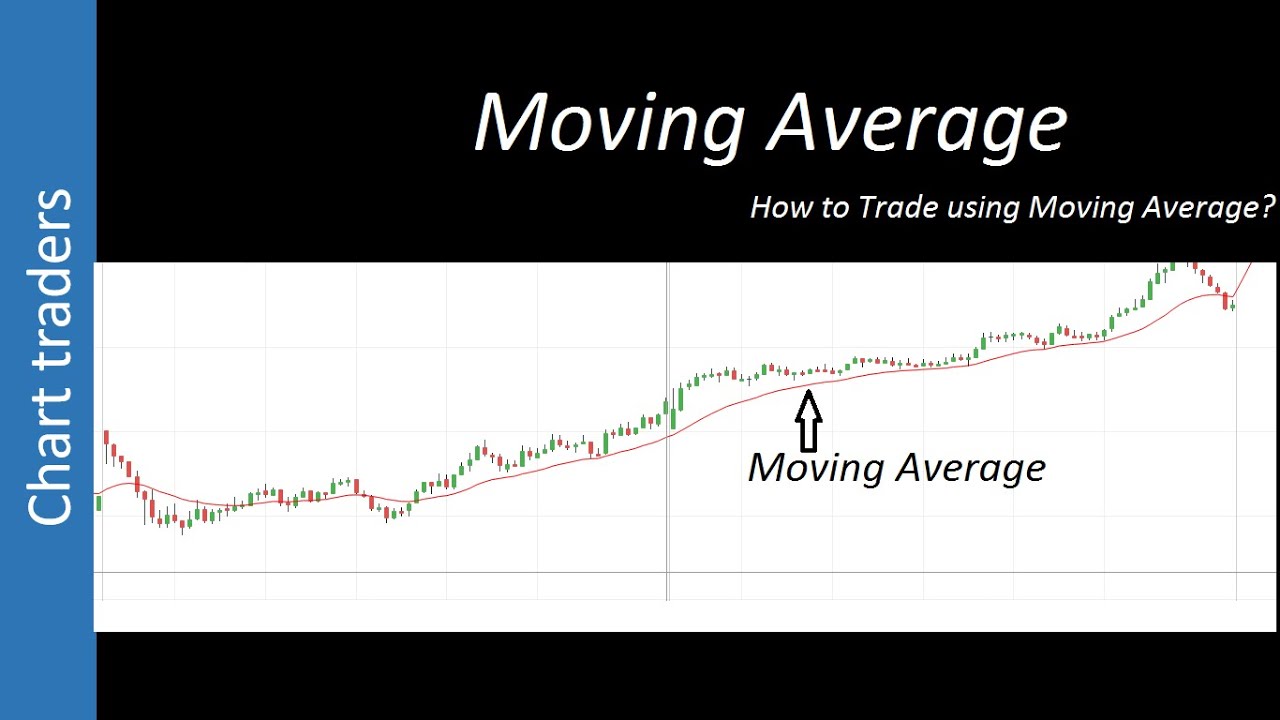

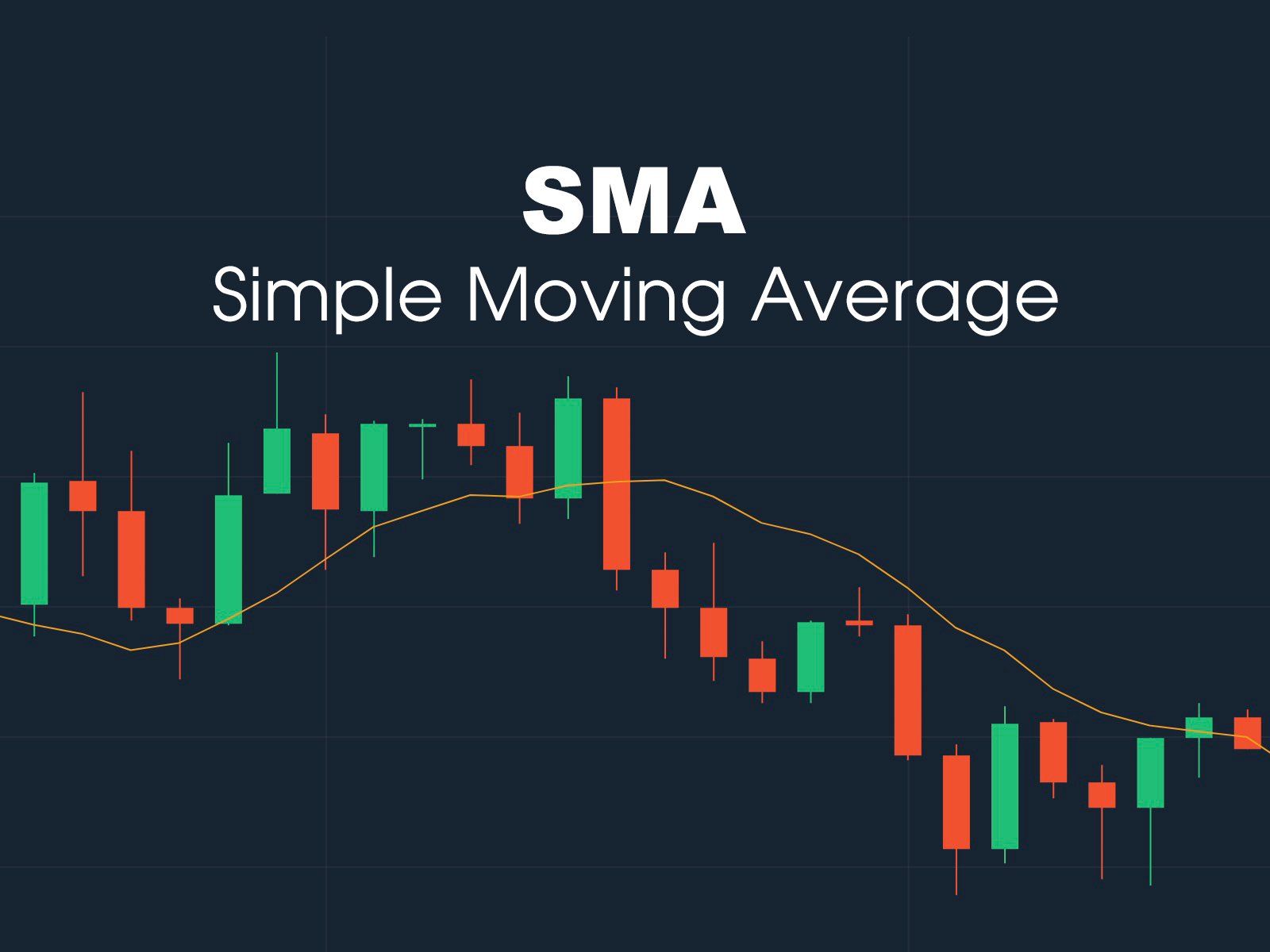

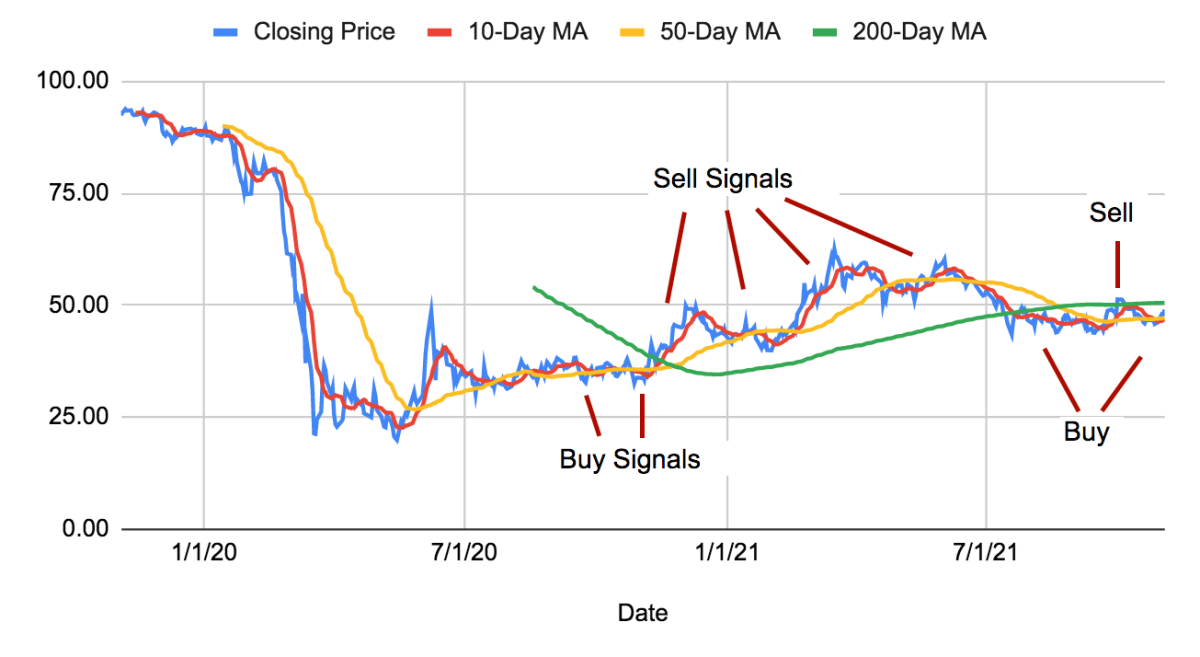

A simple moving average (sma) is a calculation that takes the arithmetic mean of a given set of prices over a specific number of days in the past. A moving average is an average of data points (usually price) for a specific time period. A moving average (ma) is a stock indicator commonly used in technical analysis, used to help smooth out price data by creating a constantly updated average price.

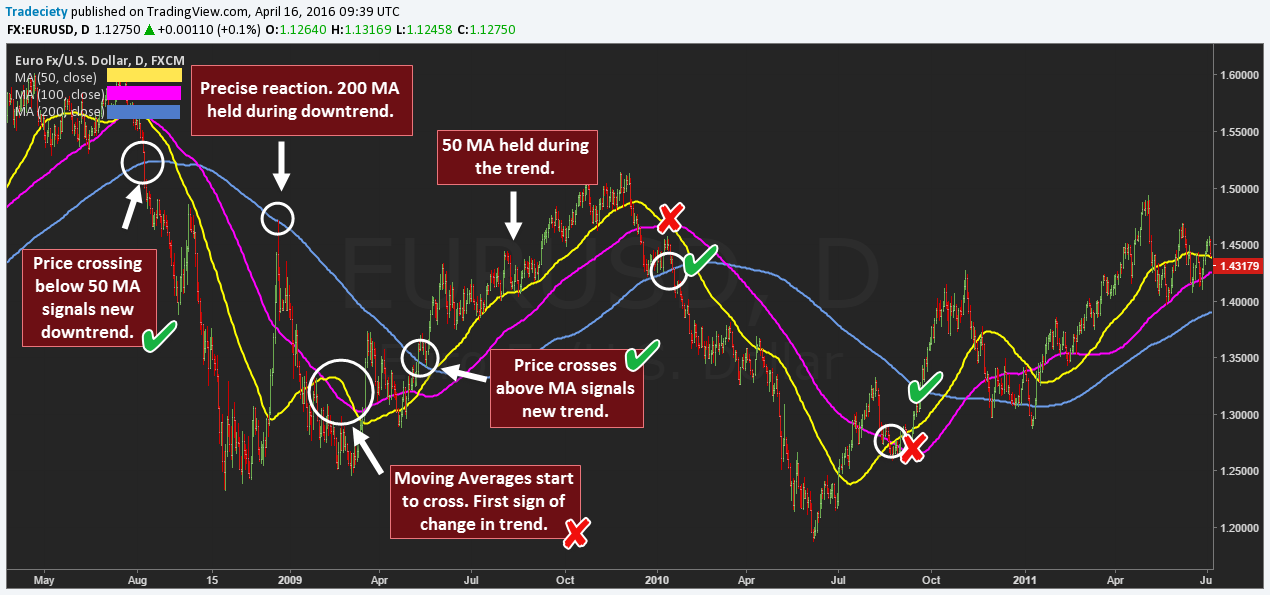

What is a moving average? The primary difference between a simple, weighted, and exponential moving average. The smoothed moving average compares recent prices to historical ones and makes sure they are weighed and considered equally.

That's because each data point is calculated using data from the previous x periods. Traders must pick periods in which to create moving averages to identify price trends. Unlike traditional moving averages, this indicator considers a more extended history of price data, which smoothes out.

Moving averages smooth out trends by removing noise, such as that from news and earnings reports. The indicator takes all prices into account and uses a long lookback period. Moving averages are a technical analysis tool that smooths price data over a specific period.

Economists use a simple smoothing technique called “moving average” to help determine the underlying trend in housing permits and other volatile data. An ema gives different weights depending on the recentness of data. Before we learn moving averages, let us have a quick recap on how averages are calculated.

It is important you acknowledge all of the feelings that can arise during this transitional time, from excitement and anticipation to. Since they take the average, they can help smooth out noisy price fluctuations, making it easier to spot trends. Being the new kid at school can stir up a lot of emotions.