Supreme Info About Why Use Arma Garch Graph Not Starting At Zero Symbol Excel

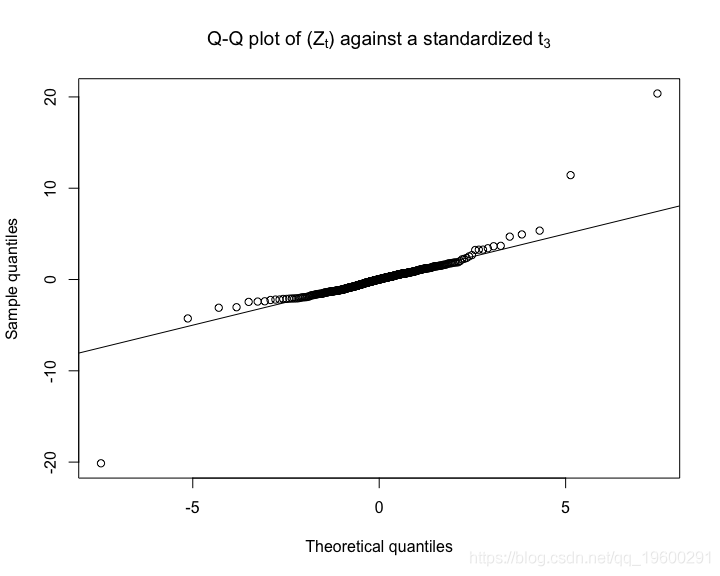

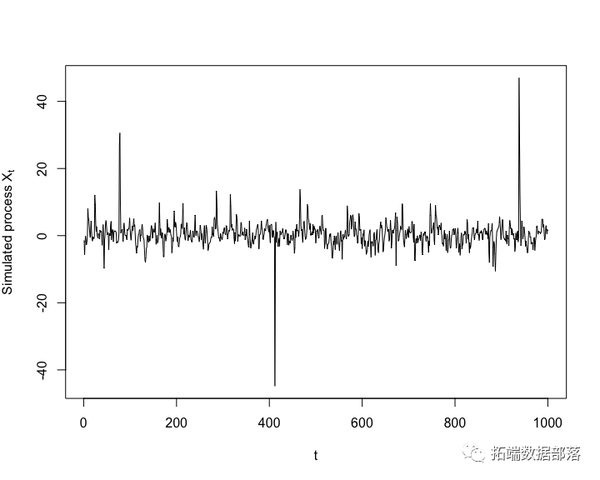

Why use arma garch. Garch(1,1) is a standard approach for modeling volatility mainly in academic literature. This article considers the adequacy of generalised autoregressive conditional heteroskedasticity (garch) model use in measuring risk in the montenegrin emerging. Both indicate that the log return of the ftse 100 index has arch effects.

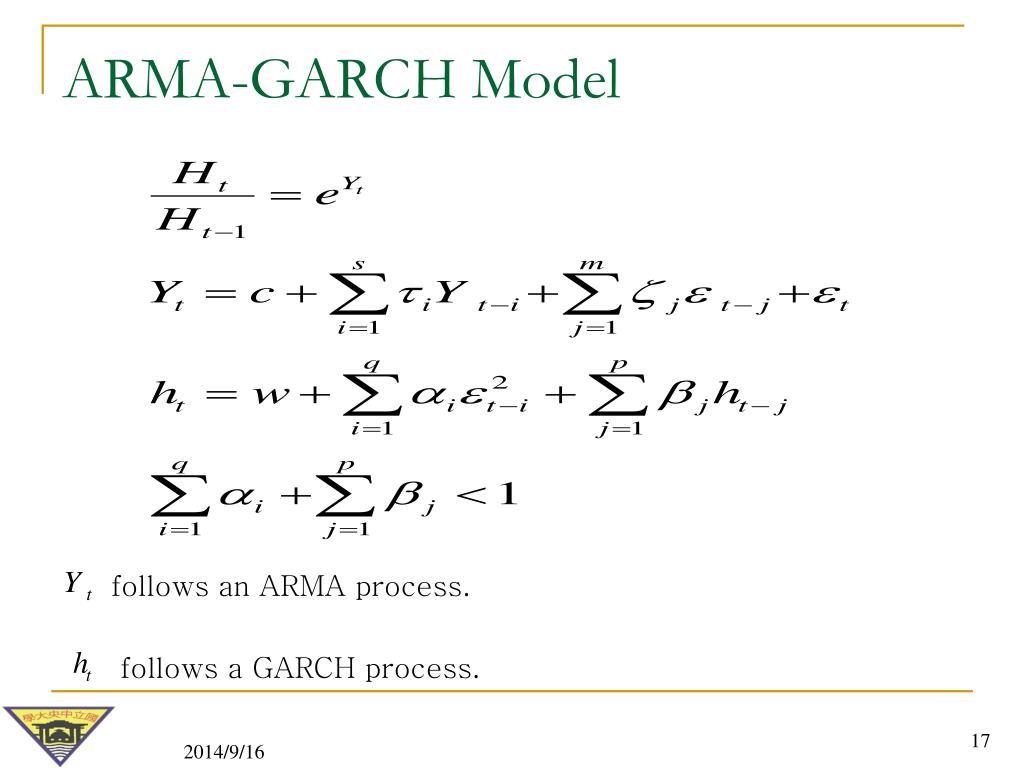

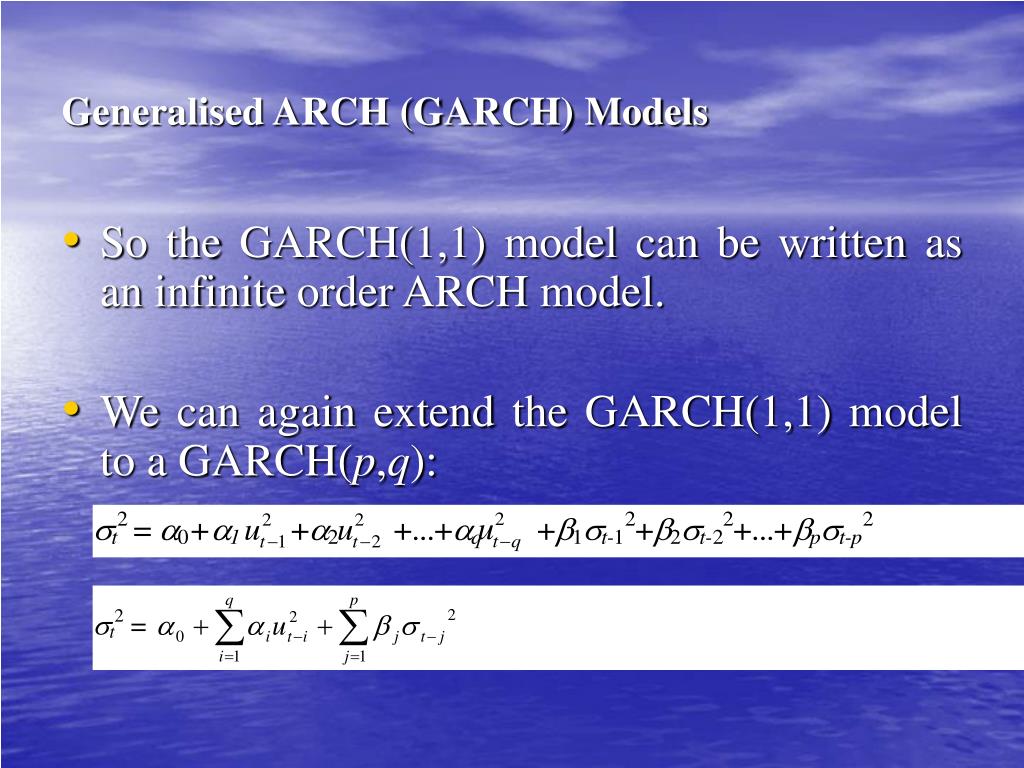

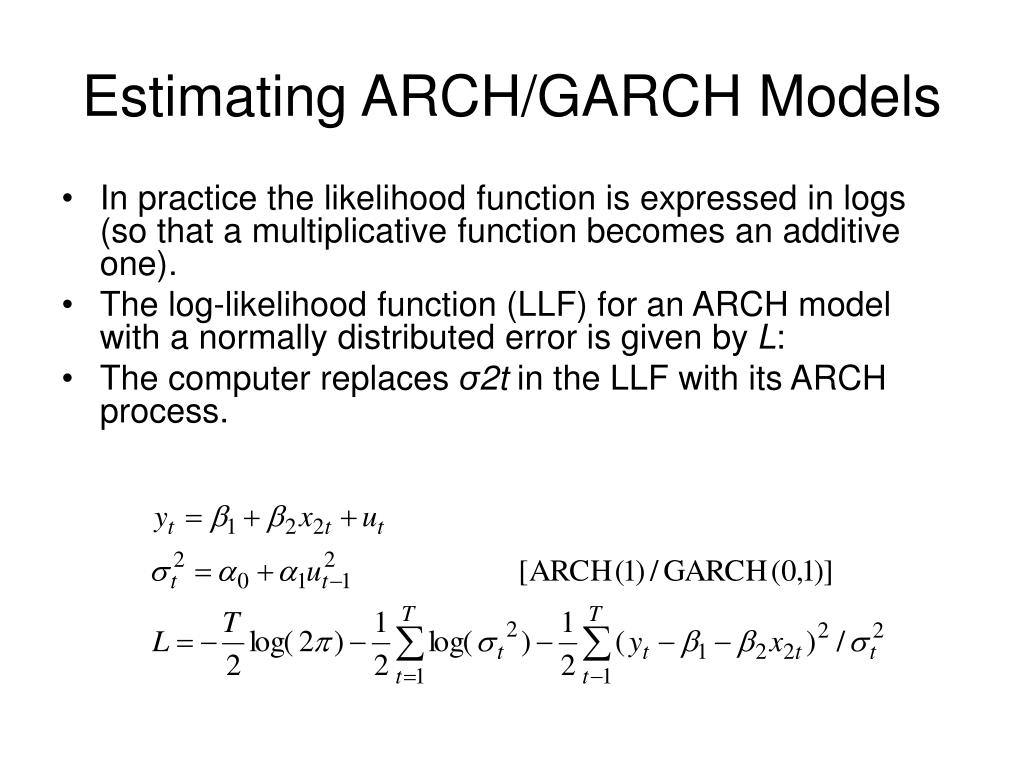

It is given by σ2 t = ω + αr2 t 1 + βσ 2 t 1 (14) where the arch term is r2 t 1 and the garch term is σ 2 t 1. However, if the volatility (the supposed changing. The arch or autoregressive conditional heteroskedasticity method provides a way to model a change in variance in a time series that is time dependent,.

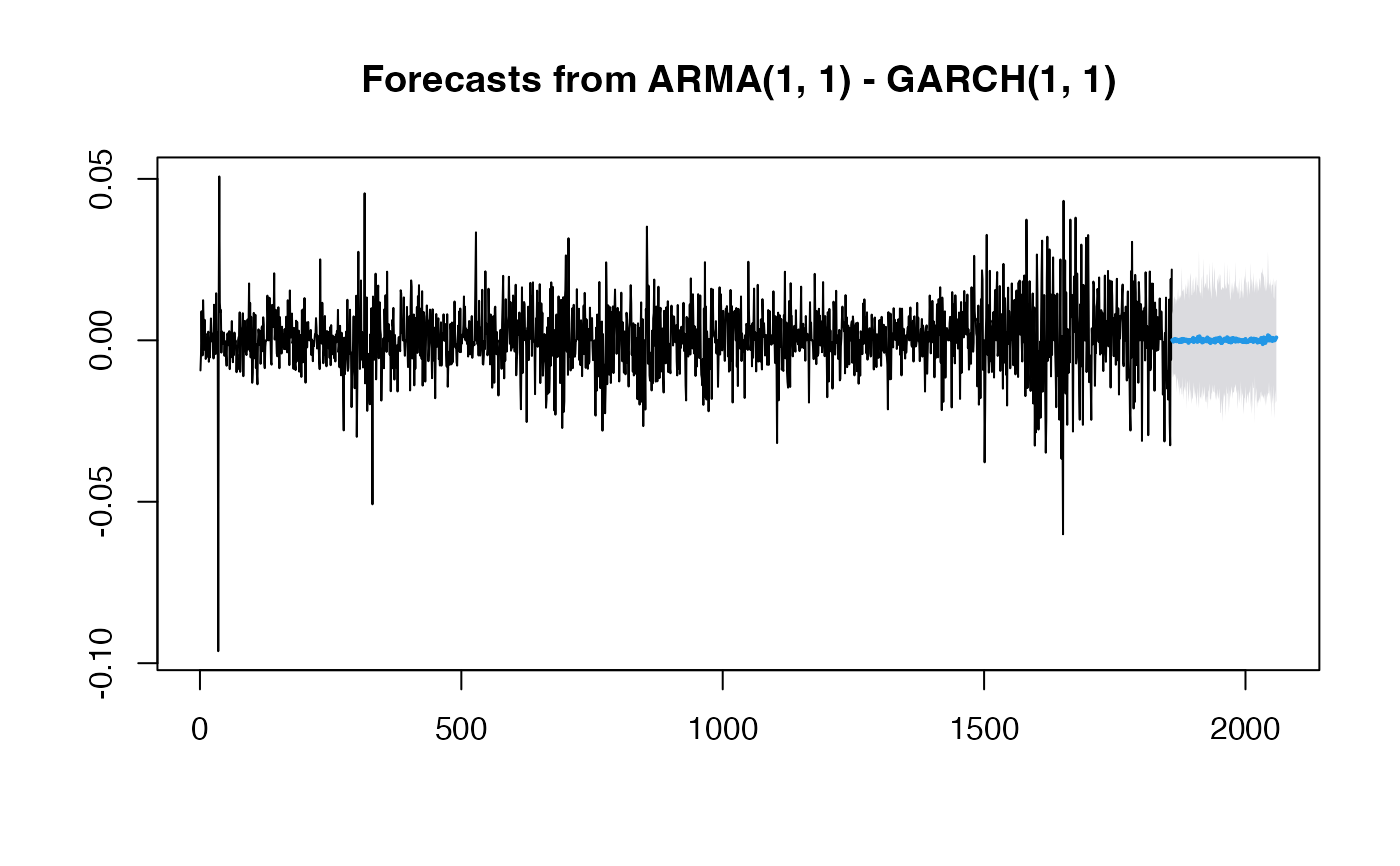

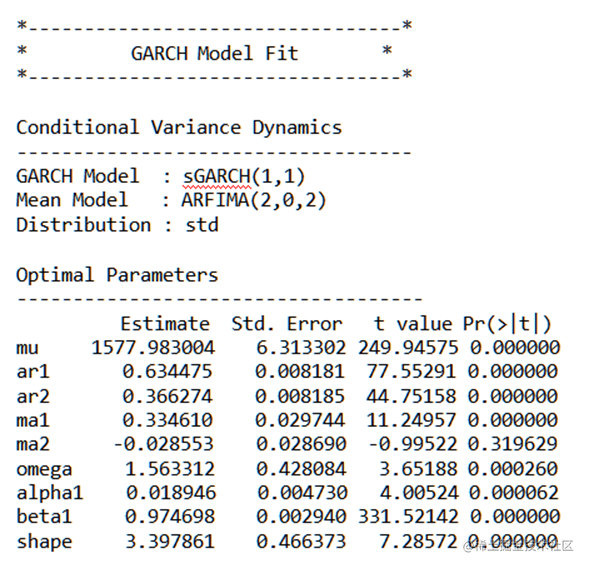

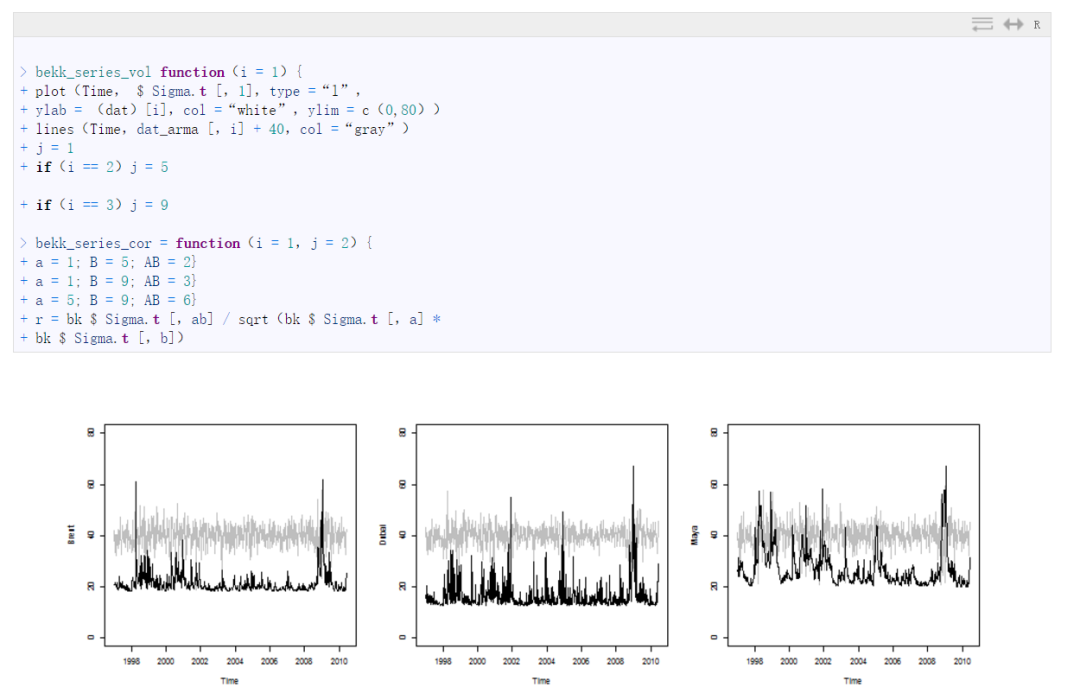

I am currently working on arma+garch model using r. From garch, you get a specific equation for the conditional variance σ2t σ t 2 directly (both the point estimates and the standard errors), while from the equivalent. I am looking out for example which explain step by step explanation for fitting this model in r.

For each day, n, the previous k days of the differenced logarithmic returns of a stock market index are used as a window for fitting an optimal arima and garch model. This post discusses the autoregressive integrated moving average model (arima) and the autoregressive conditional heteroskedasticity model (garch) and. Take a look at what is the difference between garch and.

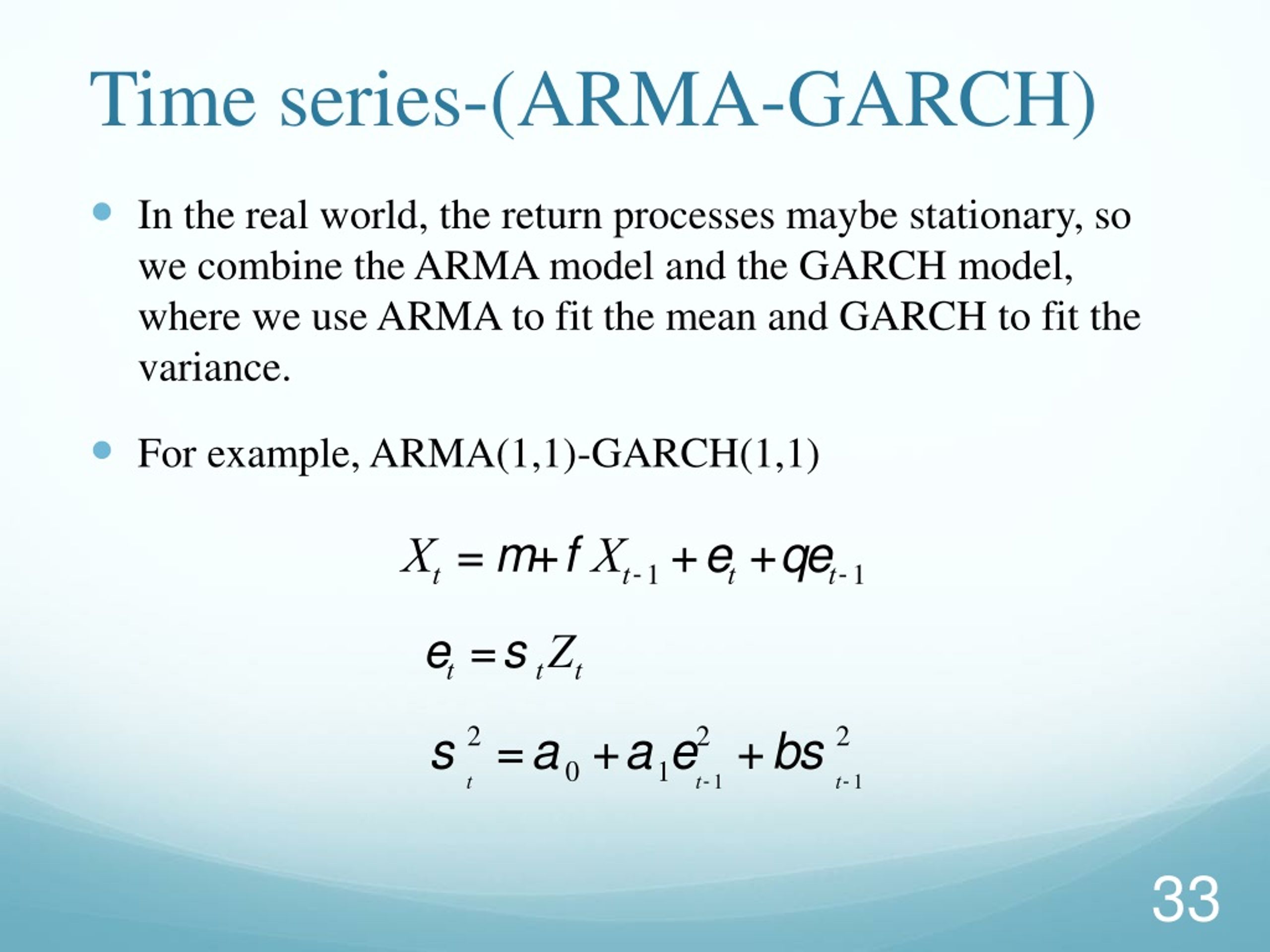

Arma being so heavily researched, well understood (both from. The model combines two types of models: Auto regressive integrated moving average (arima) models and a similar concept known as auto regressive conditional heteroskedasticity (arch) models will.

Arma and garch have different targets so they are compatible (one may use none, either or both).