Amazing Tips About What Is The Formula For Smoothed Trend 2d Line Plot Matlab

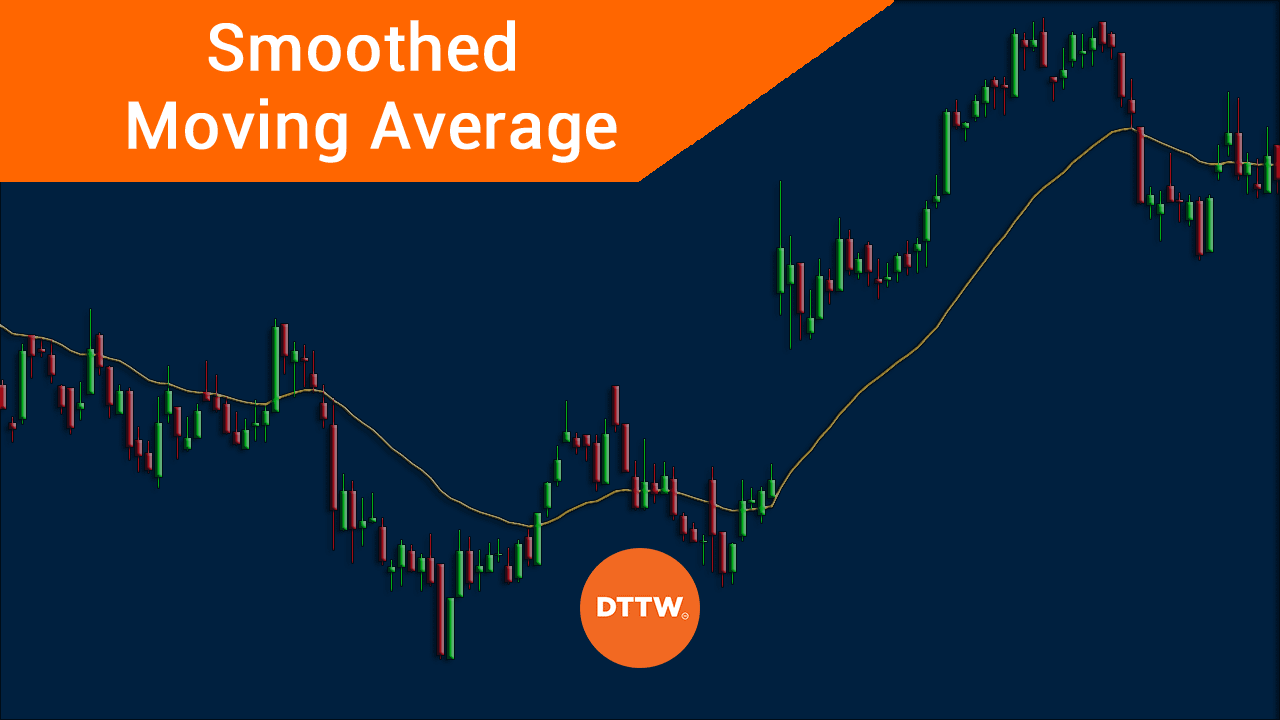

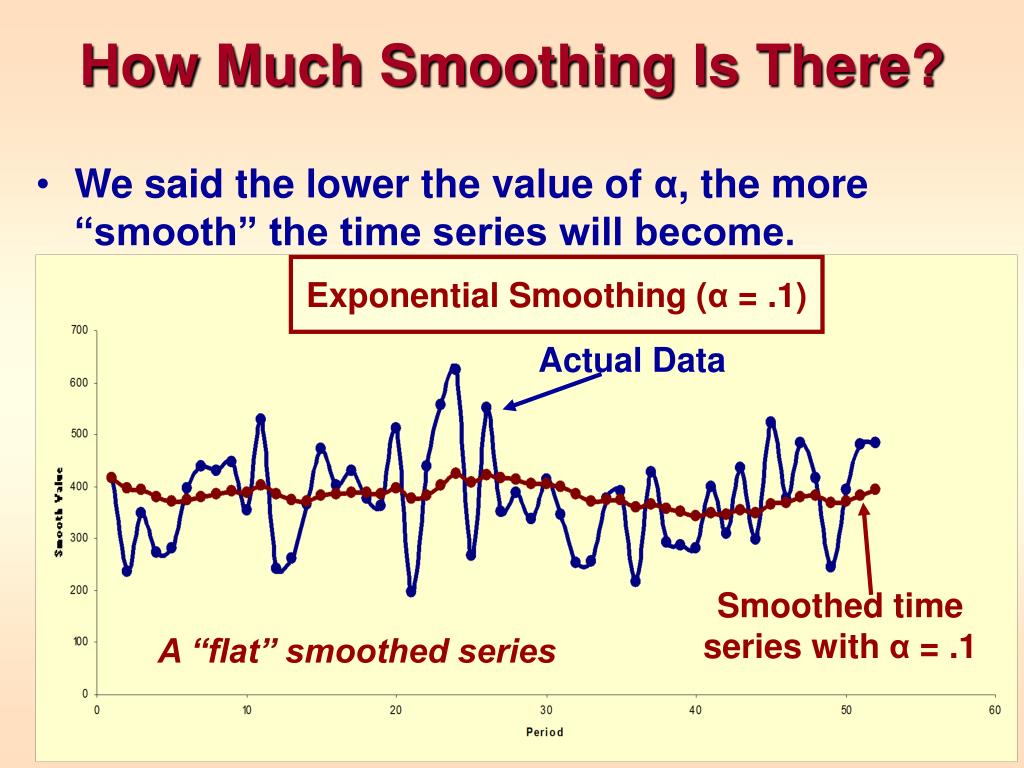

Generally smooth out the irregular roughness to see a clearer signal.

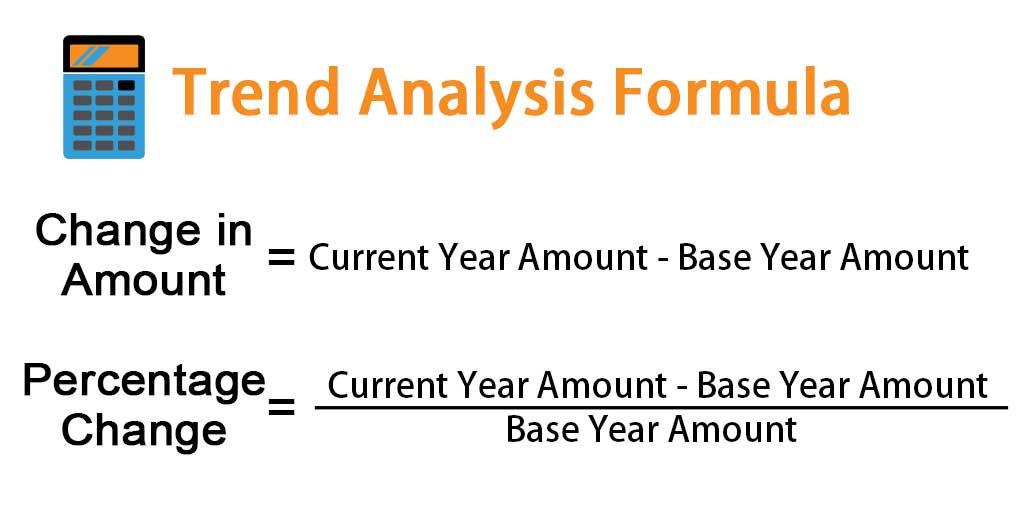

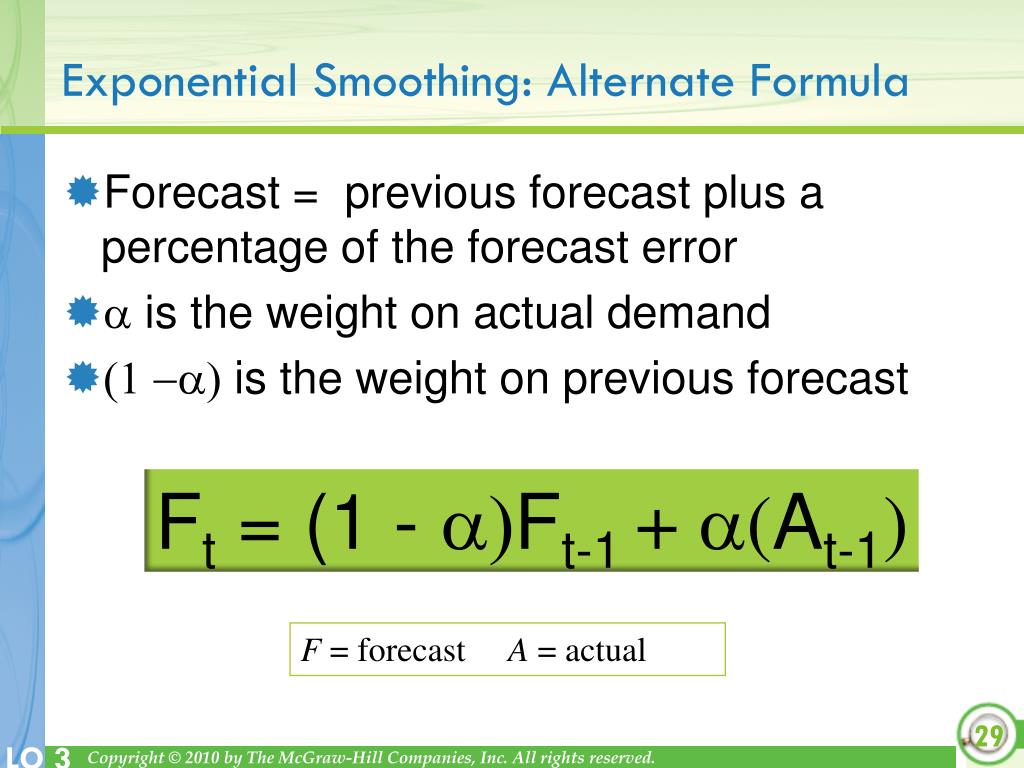

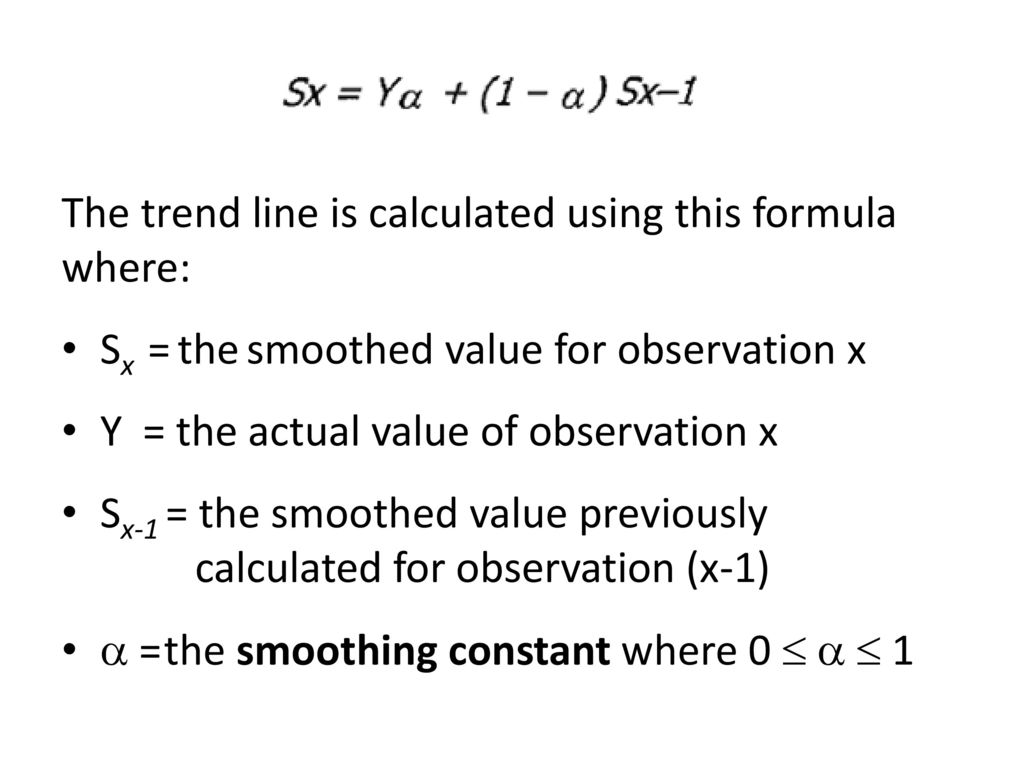

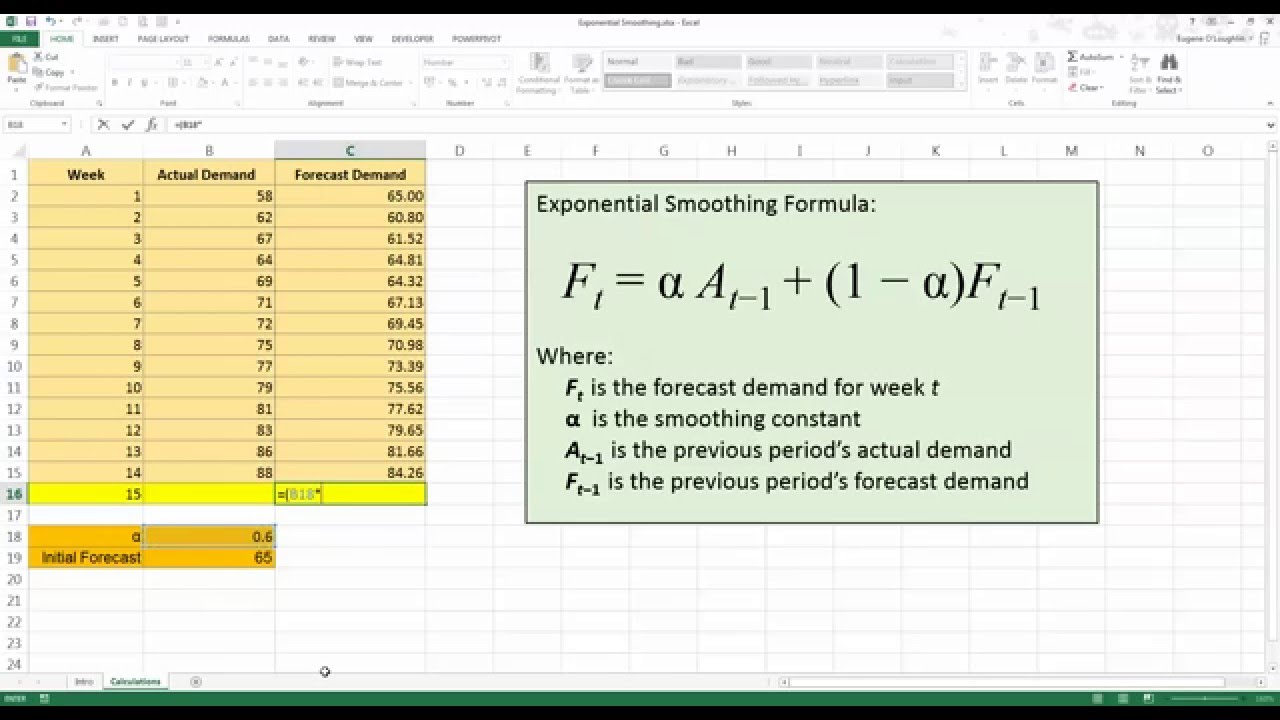

What is the formula for smoothed trend. View the full answer step 2. The smoothed moving average compares recent prices to historical ones and makes sure they are weighed and considered equally. Α = the smoothing constant, a value from 0 to 1.

The formula for calculating the smoothed moving average is: The smoothed moving average (smma) is a technical indicator used by traders to gauge price momentum and trends in a given asset. \begin {aligned} &sma = \frac { a_1 + a_2 + \dotso + a_n } { n } \\ &\textbf.

P (i) refers to the price in period (i), which is most often the closing price;. [2 ÷ (number of observations + 1)]. It can be used to confirm trends, define support and resistance areas, and spot.

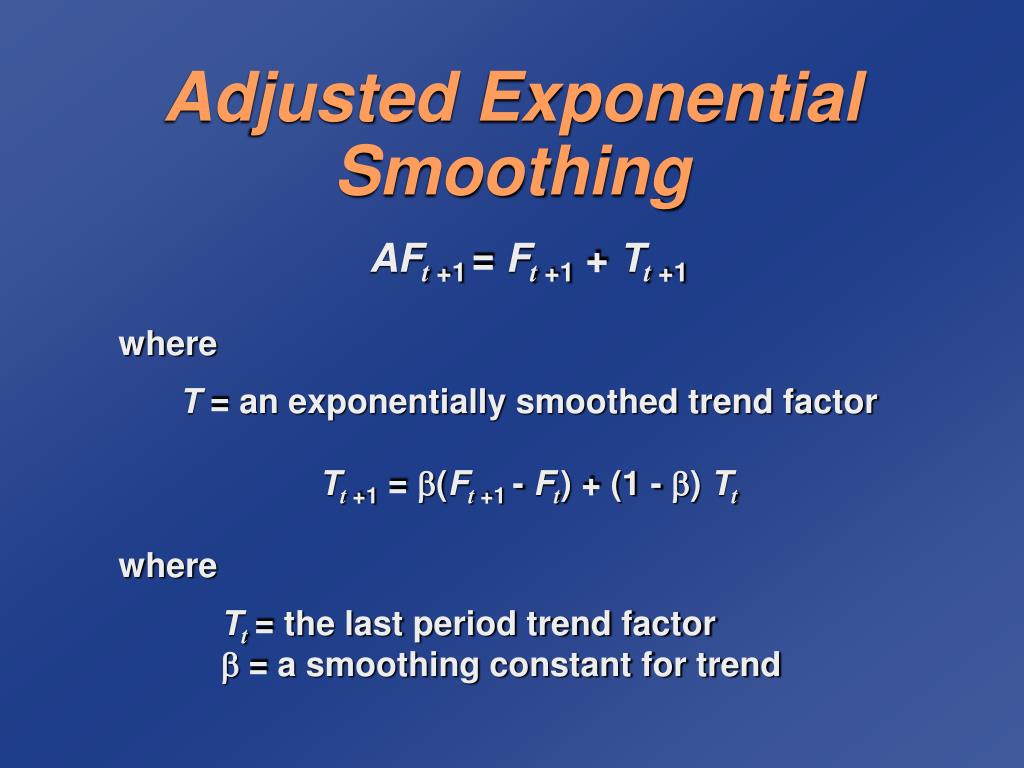

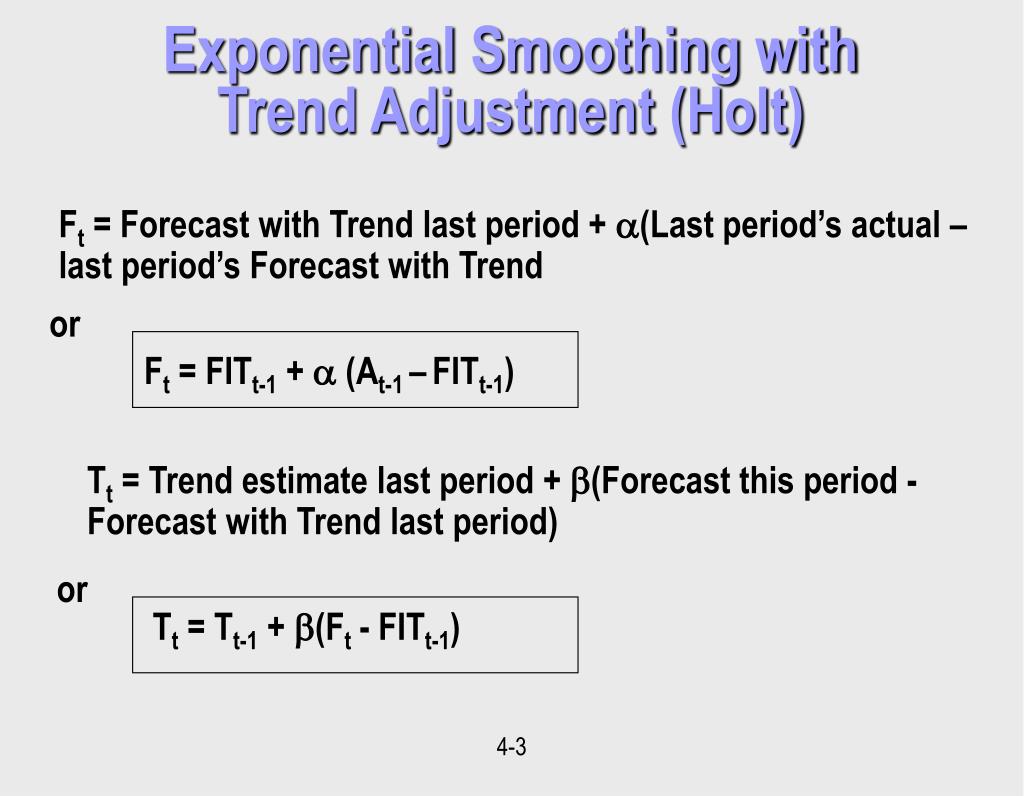

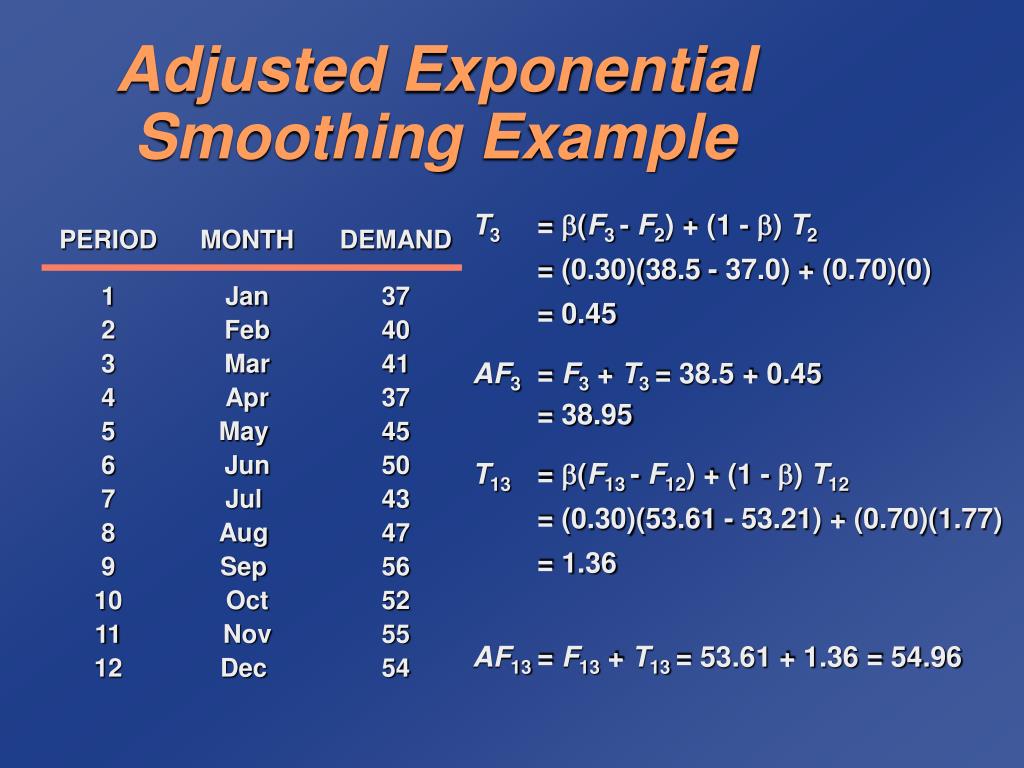

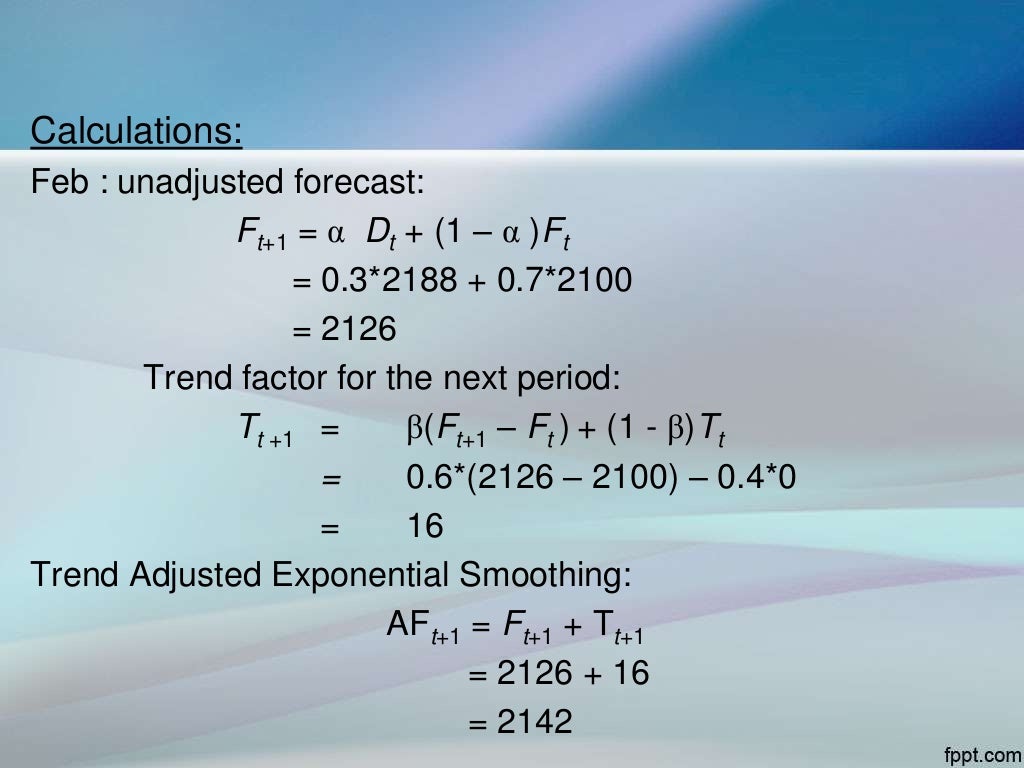

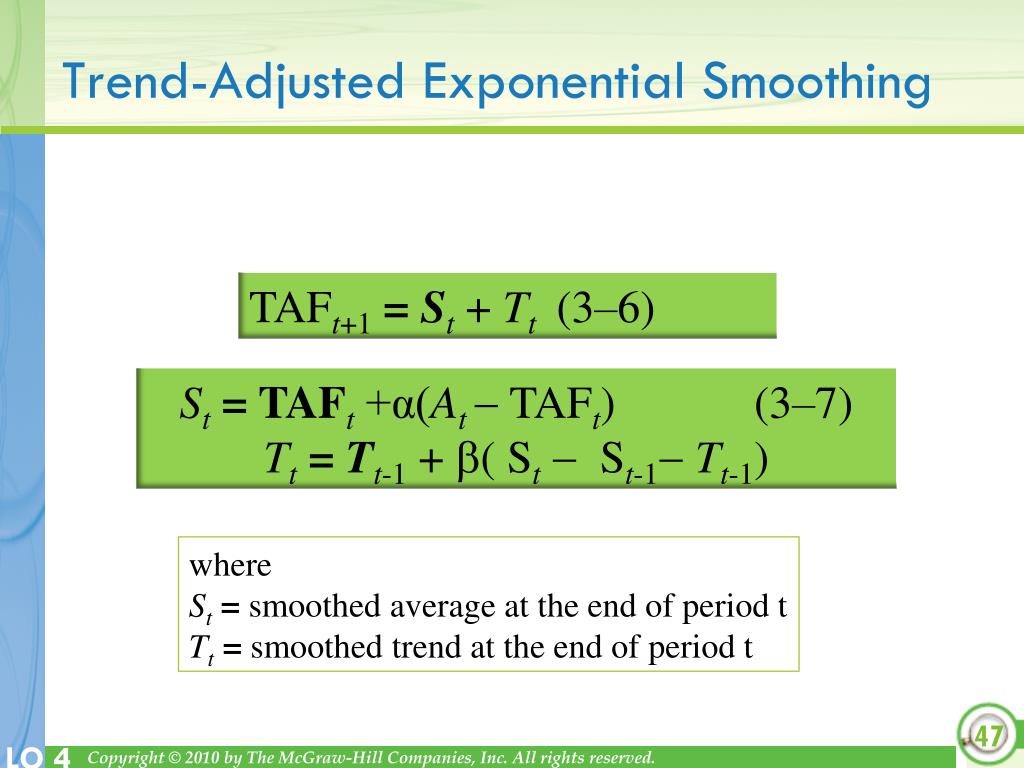

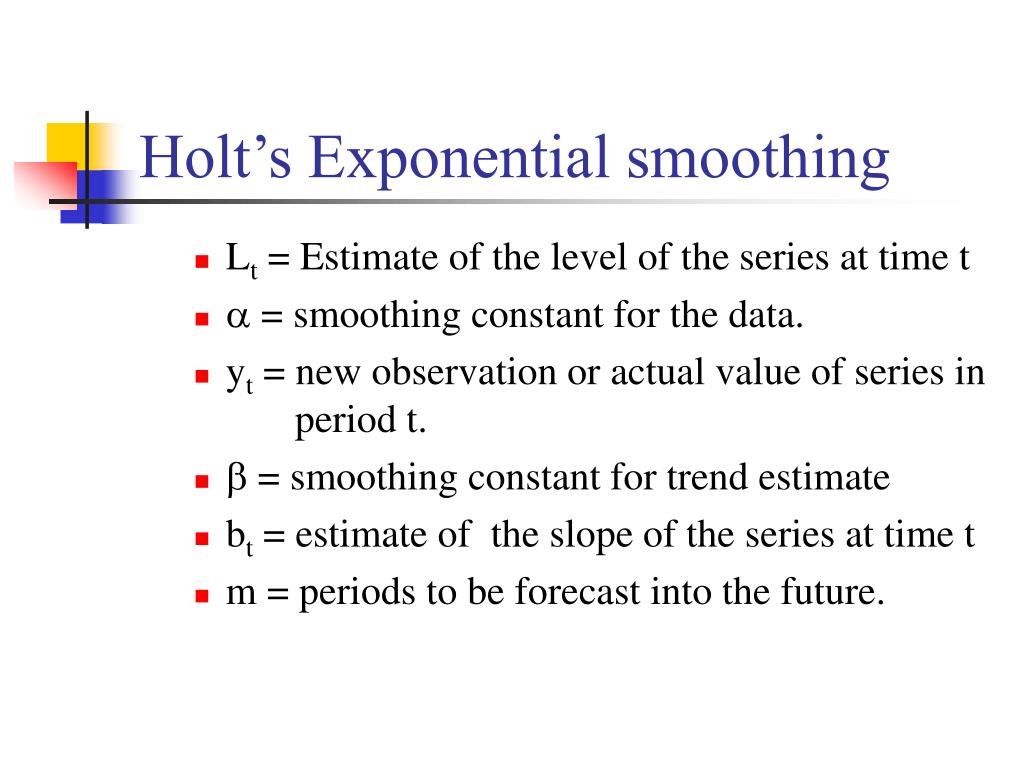

To calculate an exponentially smoothed forecast including trend (fitt), add the exponentially smoothed forecast without trend (ft) and the exponentially smoothed trend. The smoothed moving average (smma) is a technical indicator used by traders to gauge price momentum and trends in a given asset. Smma helps to reduce noise in price data, allowing traders to clearly see trends.

It can be calculated by using the following formula: Two different weights, or smoothing parameters, are used to update these two. When α is close to zero, smoothing.

Unlike traditional moving averages, this. Next, you must calculate the multiplier for smoothing (weighting) the ema, which typically follows the formula: Smoothed moving averages (smas) are a type of technical analysis tool that traders use to identify market trends, support and resistance levels, and potential entry and exit points.

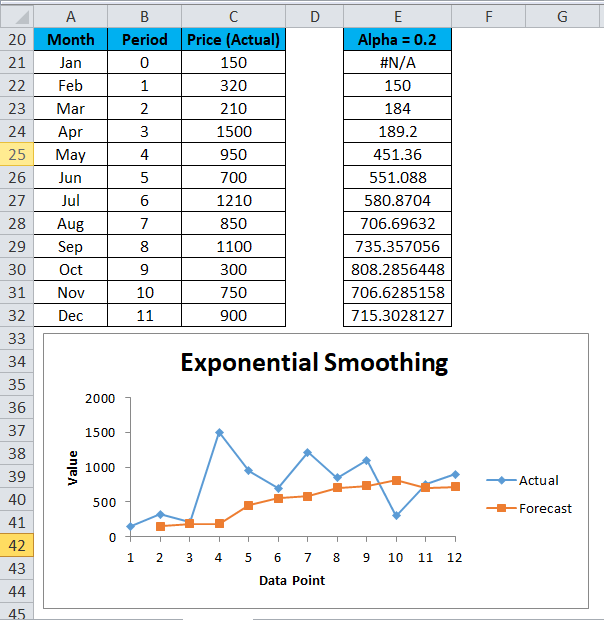

This formula considers the price changes over time,. Exponential smoothing in excel (in simple steps) this example teaches you how to apply exponential smoothing to a time series in excel. The smoothed moving average, or smma formula, is a popular method used to calculate and analyze trends in financial data.

Here's a breakdown of the compon. The formula for calculating the simple moving average of a security is as follows: Exponential smoothing is used to.

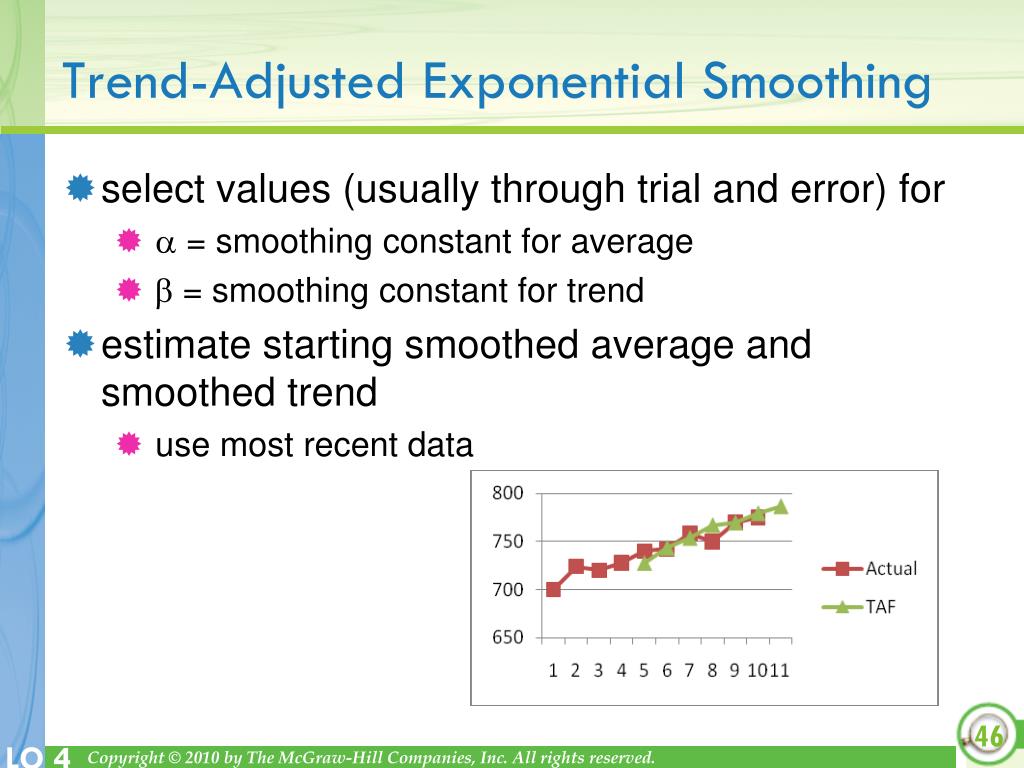

Smoothing is usually done to help us better see patterns, trends for example, in time series. Essentially the method creates a forecast by combining exponentially smoothed estimates of the trend (slope of a straight line) and the level (basically, the intercept of a straight line). The correct answer is the exponentially smoothed trend for period t.